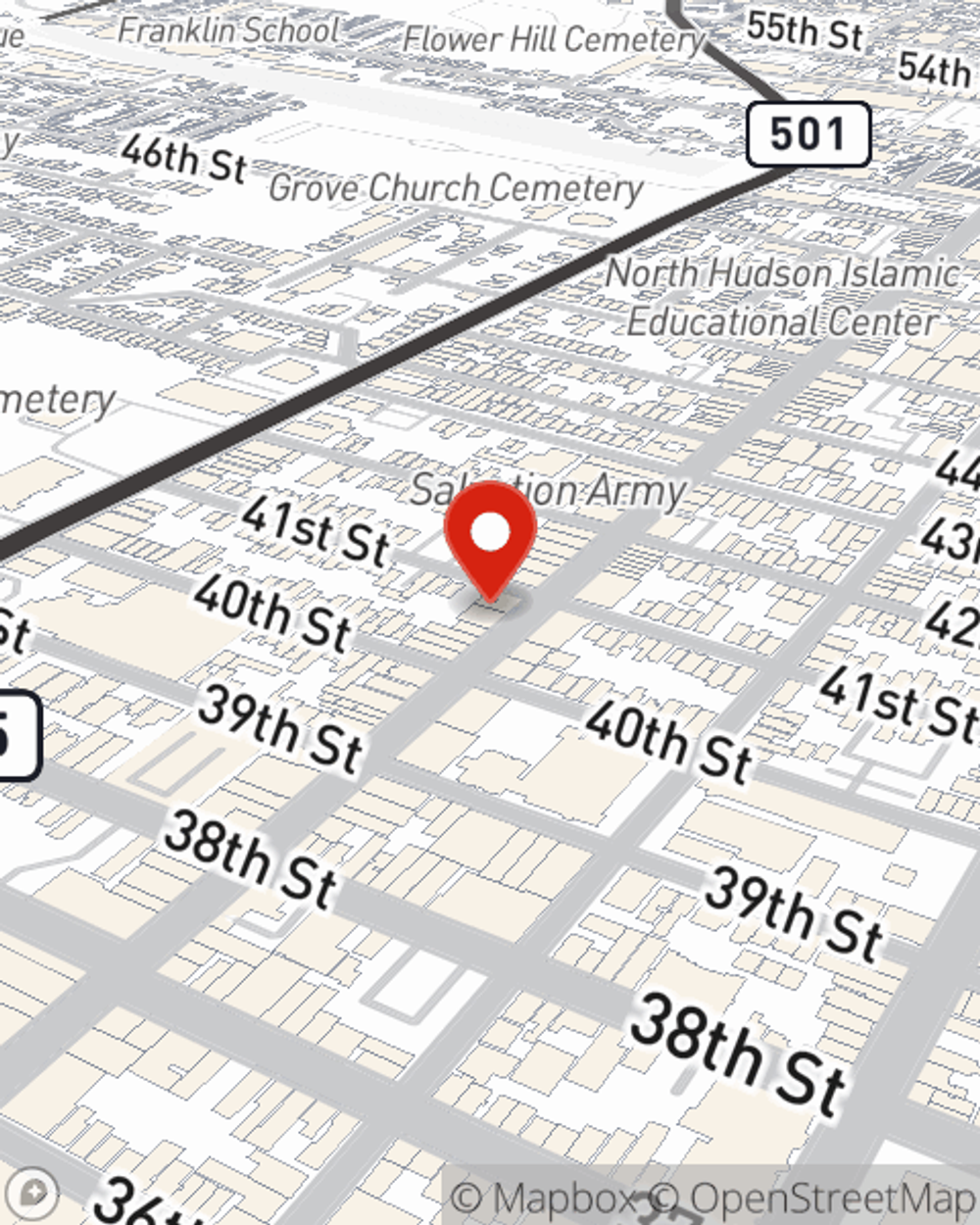

Insurance in and around Union City

Need insurance? We got you.

Cover what's most important

Would you like to create a personalized quote?

- West New York

- North Bergen

- Weehawken

- Fort Lee

- Edgewater

- Jersey City

Celebrating 100 Years Of Good Neighboring

State Farm understands the need to protect what's important to you and has developed an extended range of insurance products with personalized pricing plans to help make life go right. From vehicle and motorcycle insurance that protects your ride, to your boat, motorhome, RV, and off-road ATV, State Farm has competitive prices and easy claims to help you protect them all. Contact Candida Seymour for a Personalized Price Plan.

Need insurance? We got you.

Cover what's most important

Our Broad Range Of Insurance Options Are Outstanding

Some of these excellent options include Motorcycle, Life, Condo and Pet insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

Mobile health technology and telemedicine is aiding seniors

Mobile health technology and telemedicine is aiding seniors

Mobile health monitoring devices and telemedicine provide doctors with more diagnostic tools and convenience for patients.

Remember the basics: Cooking outdoors and food storage safety

Remember the basics: Cooking outdoors and food storage safety

Food safety and illness prevention is important when cooking and dining outdoors. We have food prep, storage and cooking tips.

Candida Seymour

State Farm® Insurance AgentSimple Insights®

Mobile health technology and telemedicine is aiding seniors

Mobile health technology and telemedicine is aiding seniors

Mobile health monitoring devices and telemedicine provide doctors with more diagnostic tools and convenience for patients.

Remember the basics: Cooking outdoors and food storage safety

Remember the basics: Cooking outdoors and food storage safety

Food safety and illness prevention is important when cooking and dining outdoors. We have food prep, storage and cooking tips.